Foreign Portfolio Investors (FPIs) turned net buyers in the Indian stock market in December, reversing their selling trend from the previous two months. This shift brought their net investments in Indian markets into positive territory for the year.

In the fourth quarter of 2024, FPIs adopted a risk-off approach due to high valuations, rising US Treasury yields, China’s economic stimulus measures, and subdued Q2 earnings from India Inc. However, renewed FPI buying activity in December offset earlier outflows, resulting in an overall positive net investment for the calendar year 2024.

FPI Flows

As per NSDL data up to December 30, FPIs invested ₹17,045 crore into Indian equities in the month so far, taking their total investments to ₹2,026 crore in 2024. In the debt markets, FPIs invested ₹8,404 crore in Fully Accessible Route (FAR) government securities during the month.

Thus, overall FPI investment into Indian markets, including debt securities, during December month is ₹28,146 crore, while that for the full year 2024 so far amounts to ₹1,67,977 crore, NSDL data showed.

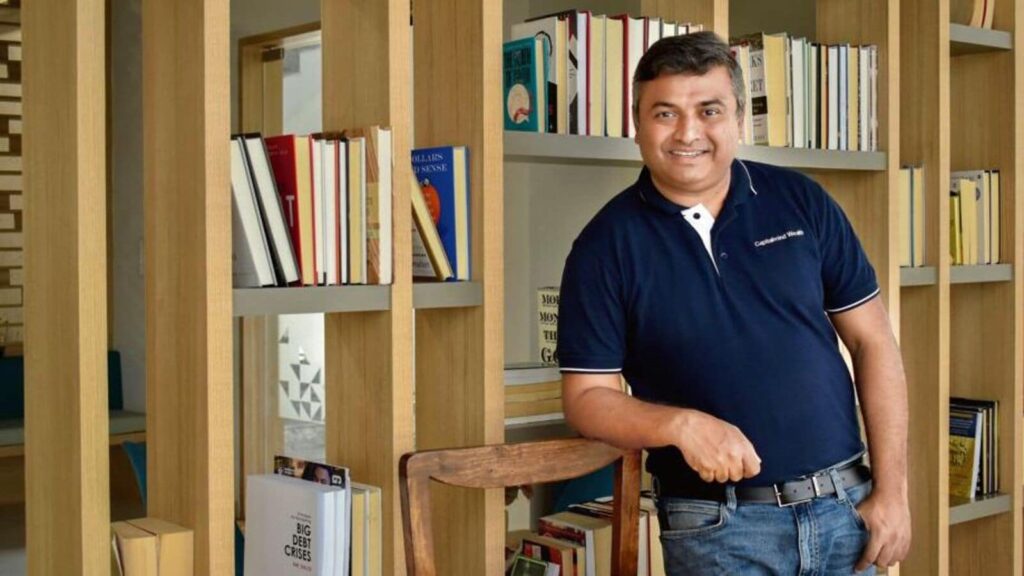

Deepak Shenoy, Founder and CEO of Capitalmind PMS, highlighted the mixed investment patterns of FPIs in India during December 2024. Citing data from NSDL, Shenoy noted that FPIs invested ₹28,000 crore during the month, with ₹17,000 crore directed towards equities, primarily through the primary market via Initial Public Offerings (IPOs) and Qualified Institutional Placements (QIPs).

“Debt for FPIs goes back positive with strong inflows of 8,000 cr in FAR securities. (Essentially govt bond where there are no FPI limits) Total inflows of 11,000 cr. including hybrids and mutual funds. In 2024 (calendar year), FPIs have invested over 160,000 cr. in debt, and a net 2,000 cr. in equity. In the last quarter, FPIs seem to have sold around 98000 cr. ($12bn) of equity, but the FDI+FPI+NRI deposits in the first three quarters were $54 bn. We have seen net inflows,” Shenoy explained in a post on X (formerly Twitter).

Shenoy also highlighted the broader inflow picture, noting that FDI, FPI, and NRI deposits collectively brought $54 billion into the Indian economy in the first three quarters of 2024.

His insights underline the nuanced sentiment of foreign investors, balancing optimism in debt instruments with caution in equities. The observations reflect the broader economic narrative of India as a stable yet dynamic market for global investors, capable of attracting significant inflows even in volatile times.

Samir Arora, Founder of Helios Capital also shared insights on Foreign Institutional Investor (FII) flows in India for 2024. According to Arora, FIIs have recorded net positive flows for the year despite being net sellers in secondary markets.

He attributed this trend to substantial investments in primary issues such as IPOs and QIPs, which more than offset their selling in secondary markets.

“FII flows are overall positive in India in 2024 (and negative in secondary markets). Overall FIIs compensated for their selling in secondary markets by buying even more in primary issues and QIPs etc,” Arora said in a post on X.

This highlights FIIs’ strategic shift toward capitalizing on fresh equity opportunities while reducing exposure in the secondary market. Arora’s observation underscores the mixed but ultimately positive sentiment of FIIs toward Indian markets in 2024.

Disclaimer: The views and recommendations made above are those of individual analysts or broking companies, and not of Mint. We advise investors to check with certified experts before making any investment decisions.

Catch all the Business News , Market News , Breaking News Events and Latest News Updates on Live Mint. Download The Mint News App to get Daily Market Updates.

MoreLess

🎯 YouTube Tag Generator (Powered by Google Gemini)

⏳ Generating tags using Gemini API, please wait...